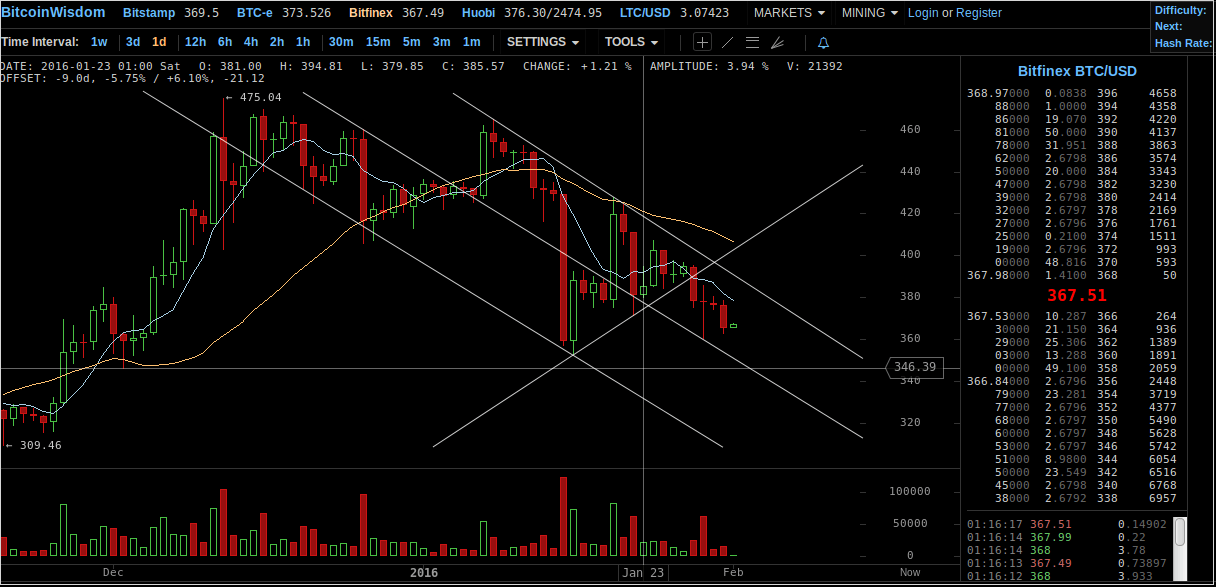

Sell: now or up to $380. Take Profit: 350; 335; 315

Buy:380 SL: 375 TP: 385; 390

The BTC/USD price downtrend was confirmed last week with the Thursday daily candle sell signal after several days of consolidation. And although the Friday’s candle formed a doji suggesting some buying pull-back, this scenario looks off the table currently as the price keeps pushing down.

A nice downtrend channel has formed there with some minor support/resistance in the middle (now somewhere around $350). If broken we can see a brief spike to $310 very soon.

Trading fiat scamcoins?

Strong: Usd, Cad

Weak: Jpy, Eur

Indices

DAX: choppy zone, somewhat bullish

DJ: bullish