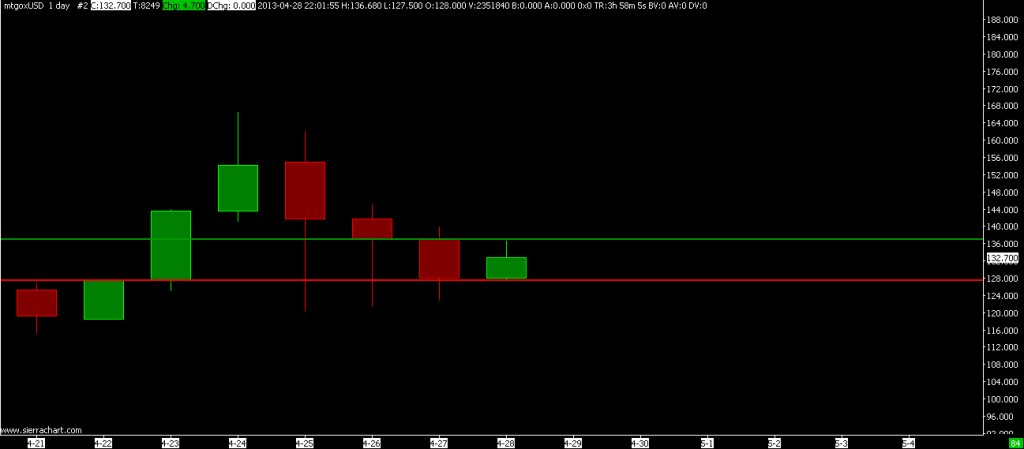

An overall situation in the BTCUSD market is a quite tricky right now. It is a long term range trading between a high of 260 USD and low at 50 USD. The price broke down into a medium-term bear market last week, but weekend recovery suggests we can see some small up move again before another downfall leg later. You know that saying ‘what can’t go up must come down’…

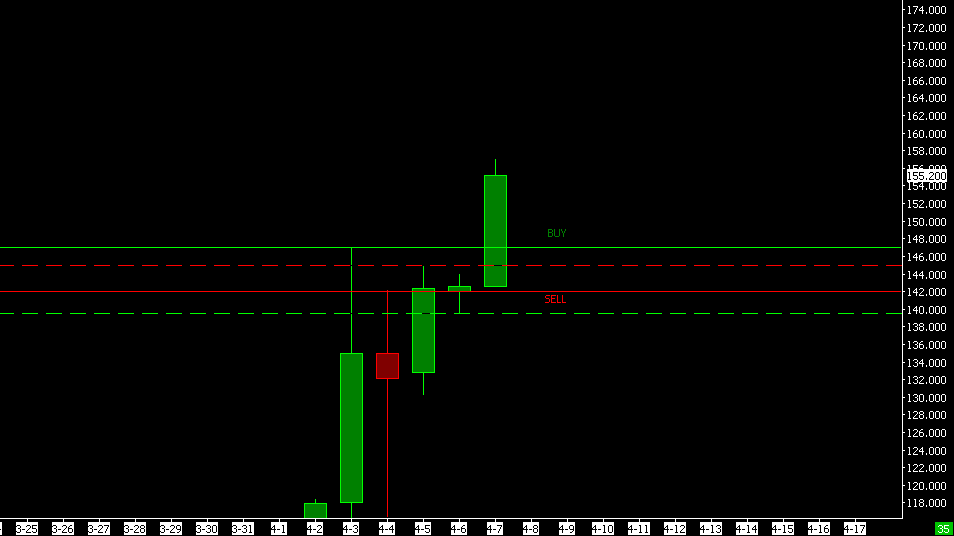

Here are my points for this week:

Buy 119.40 SL 114.00 PT1: 124.80 PT2: 135.00 PT3: 146.00

Sell 106.70 SL 115.30 PT1: 93.00 PT2: 81.00 PT3: 71.00 PT4: 60.00

Summing up the last week trading results: +22%

Buy PT1: +5%

Sell PT1: +4%, PT2: +12%, PT3: +17%

If you let a profit run with the falling market and would close on Friday afternoon (which I would recommend for at latest), you could book even 33% return (supposing 85 USD target for example) only for that one sell off.

Also bear in mind that buy and sell points I give out must be clearly broken on the chart, a spike candle (I watch 15 min. or 200 tick chart for an entry) is not enough, market has to clearly close above (below) this point. That’s why setting up a pending orders and leave computer is comfortable, but not always leading to a successful entry.