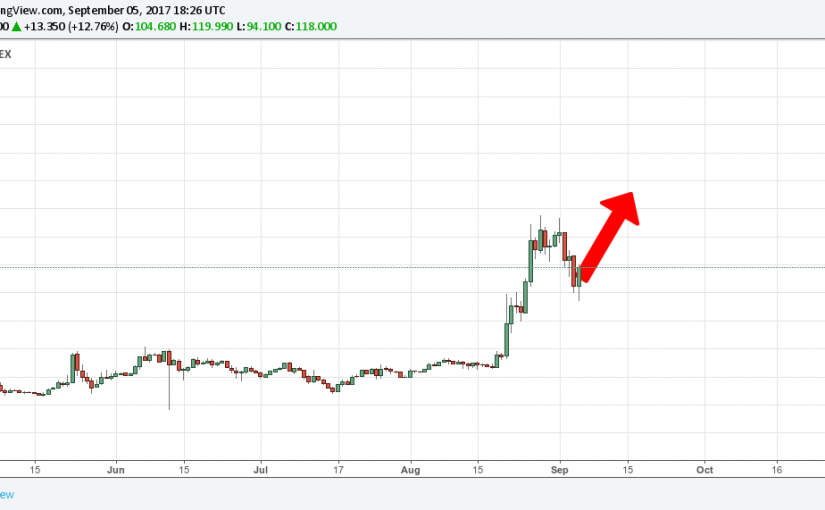

Najsilnejšími kryptomenami v mesiaci september sú monero a ether. To znamená, že tieto digitálne meny ponúkajú najviac možností špekulatívneho obchodovania v kombinácii so slabšími kryptomenami a fiat menami. Pohľad na vybrané sledované grafy jednotlivých krypto a krypto-fiat párov ponúka dostatočný počet silných príležitostí na nákup monera a etheru. Pomerne silné postavenie pre najbližšie týždne ukazuje aj dash.Bitcoin sa po nákupných hodoch minulý mesiac trochu ukľudňuje a silné postavenie vykazuje iba voči doláru a euru. Čiže potenciálny špekulatívny nákup BTC/USD a BTC/EUR pripadá do úvahy aj tento mesiac. Všetky ostro sledované páry pre tento mesiac sú uvedené nižšie. *** Obchody s najvyššou pravdepodobnosťou zisku ZEC/XMR: čakáme na predajný signál, čiže priblíženie sa k cene 2,8. XMR/USD: nákupný signál a možný vstup práve teraz BTC/USD: nákupný signál a možný vstup práve teraz. BTC/EUR: nákupný signál a možný vstup práve teraz. Dash/XMR: čakáme na predajný signál, čiže priblíženie sa k cene 3,5. Dash/USD: cena je blízko nákupného signálu. ETC/ETH: cena sa nachádza v predajnej zóne, čakanie na signál na predaj. ETH/USD: cena sa nachádza v nákupnej zóne, čakanie na nákupný signál. ETH/EUR: cena sa nachádza v nákupnej zóne, čakanie na nákupný signál. ** Obchody s nižšou pravdepodobnosťou zisku LTC/XMR: čakanie na korekciu k 0,7 a prípadný signál na predaj. XMR/BTC: opatrný signál na nákup práve teraz. Dash/BTC: čakanie na nákupný signál okolo 0,66. ------------------------------------------------------------ Špekulatívne obchodovanie uvedených párov sa riadi určitými konkrétnymi pravidlami, ktoré nie sú v tomto prehľadovom avíze uvedené. Na tomto mieste sú iba vymenované páry, ktoré nás zaujímajú počas najbližších týždňov. V prípade záujmu o konkrétnejšie informácie nás kontaktujte.[gourl-lock img="image2.jpg"]

Tag: Monero

Obchodovanie s kryptomenami v auguste – vyhodnotenie

Vývoj ceny kryptomien v auguste potvrdil naše špekulatívne očakávania, a to najmä v kategórii nastavení s najvyššou pravdepodobnosťou úspechu. Avizované najsilnejšie postavenie bitcoinu spomedzi všetkých sledovaných kryptomien vyústilo do zisku pri všetkých pároch, kde bola pozícia otvorená (označené zelenou farbou). *** Obchody s najvyššou pravdepodobnosťou zisku Dash/BTC: hoci očakávaný výpredaj nastal a trval až do polovice augusta, cena kryptopáru neskorigovala k predajnej zóne a žiadna pozícia tak nebola otvorená. XRP/BTC: predajná pozícia otvorená po korekcii k predajnej zóne, cieľová úroveň zasiahnutá. FCT/BTC: predajná pozícia otvorená a cieľ zasiahnutý, možný opätovný vstup koncom augusta. ZEC/BTC: krátka pozícia otvorená a cieľ takmer zasiahnutý 15.8. alebo dnes. XMR/BTC: krátka pozícia s úspešne zasiahnutým cieľom ešte pred obratom ceny nahor. BTS/BTC: žiadny obchod,cena nevystúpila k predajnej zóne. BTC/USD: žiadny obchod, cena už neskorigovala k nákupnej zóne. ETH/BTC: krátka pozícia otvorená a momentálne v zisku.Menej silné nastavenia grafov sa tentokrát ukázali oprávnene menej úspešné, keď stratou skončili predaje ETC voči fiat menám, ako I Auguru (REP) voči euru. Pri zvyšných dvoch kryptopároch nedošlo k obchodným signálom. ** Obchody s nižšou pravdepodobnosťou zisku LTC/BTC: žiadny obchod, cena už nevystúpila k predajnej zóne. ZEC/XMR: žiadny obchod, cena už neskorigovala k predajnej zóne. REP/EUR: cena vystúpila na úroveň vhodnú k predaju, no nepokračovala v klesajúcom trende a pozícia skončila v strate. ETC/USD: vývoj ceny signalizoval predaj, kurz páru klesol blízko úrovne výberu zisku, no nezasiahol ju. Realizovaný stoplos. ETC/EUR: vývoj ceny signalizoval predaj, kurz páru klesol blízko úrovne výberu zisku, no nezasiahol ju. Realizovaný stoplos.

Obchodujeme kryptomeny: Bitcoin je najsilnejší v auguste

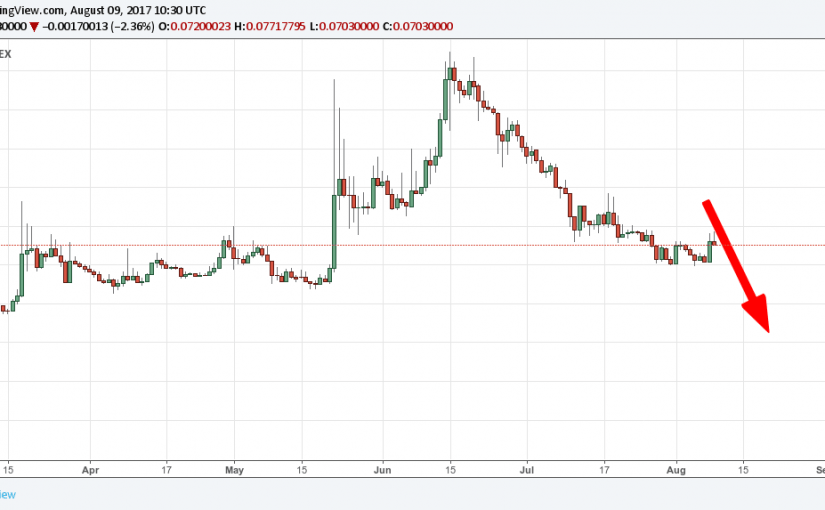

Najsilnejšou kryptomenou v mesiaci august je jednoznačne bitcoin. Pohľad na vybrané sledované grafy jednotlivých krypto a krypto-fiat párov ponúka veľa silných príležitostí na šortovanie altcoinov voči bitcoinu, ale aj nákup bitcoinu voči doláru, či euru. O niečo rizikovejšie možnosti špekulatívneho obchodovania sa črtajú pri ETC s fiatom, či Augure. Všetky ostro sledované páry pre tento mesiac sú uvedené nižšie.Dash/BTC : veľmi silné postavenie pre predaj – momentálne čakanie na korekciu k predajnej zóne XRP/BTC (Ripple): veľmi silné postavenie pre predaj – momentálne čakanie na korekciu k predajnej zóne FCT/BTC (Factom): veľmi silné postavenie pre predaj – signál na predaj aktívny, možnosť otvorenia krátkej pozície. ZEC/BTC (Z-cash): veľmi silné postavenie pre predaj – signál na predaj aktívny, možnosť otvorenia krátkej pozície práve teraz. XMR/BTC (Monero): veľmi silné postavenie pre predaj – signál na predaj aktívny, možnosť otvorenia krátkej pozície práve teraz. BTS/BTC (Bitshares): veľmi silné postavenie pre predaj – momentálne čakanie na korekciu k predajnej zóne. BTC/USD: veľmi silné postavenie pre nákup – signál a cieľ už realizovaný, momentálne čakanie na prípadný pokles ceny k nákupnej zóne. ETH/BTC (Ether): veľmi silné postavenie pre predaj – momentálne cena v predajnej zóne, čakanie na signál k predaju. LTC/BTC (Litecoin): silné postavenie (rizikovejšie ako predchádzajúce páry) na predaj - momentálne čakanie na korekciu k predajnej zóne. ZEC/XMR: pomerne silné postavenie na predaj - momentálne čakanie na korekciu k predajnej zóne. REP/EUR (Augur): pomerne silné postavenie na predaj - momentálne cena v predajnej zóne, čakanie na signál k predaju. ETC/USD (Ether Classic): silné postavenie na predaj - momentálne cena v predajnej zóne, čakanie na signál k predaju. ETC/EUR: pomerne silné postavenie na predaj - momentálne cena v predajnej zóne, čakanie na signál k predaju. ---------------- Špekulatívne obchodovanie uvedených párov sa riadi určitými konkrétnymi pravidlami, ktoré nie sú v tomto prehľadovom avíze uvedené. Na tomto mieste sú iba vymenované páry, ktoré nás zaujímajú počas najbližších týždňov. V prípade záujmu o konkrétnejšie informácie nás kontaktujte.

Obchodovanie s kryptomenami v júli – vyhodnotenie

Najsilnejšie postavenie podľa špekulatívneho postavenia grafov kryptomien v mesiaci júl ponúkal krypto pár Dash/Monero (Dash/Xmr). Hoci jeho cena vzrástla, nákupná zóna zasiahnutá nebola a preto ani žiadna pozícia nebola otvorená. O triedu slabší setup bolo možné zobchodovať pri páre Dash/BTC. Cena sa po počiatočnom šplhaní nahor na moment predsa len dostala do nákupnej zóny a zasiahla cieľovú úroveň.Podobne silné postavenie mal aj pár Litecoin/Monero (LTC/XMR). Cena výrazne stúpla, no bez otvorenia nákupnej pozície. Veľmi riskantný na obchodovanie bol pár Dash/USD. Po rýchlom štarte nahor cena nakoniec zasiahla nákupnú úroveň, aby potom otestovala hranicu stoplosu a trpezlivosť obchodníkov. Vzápätí však predsa len Dash nekapituloval, rýchlo sa otočil a cieľ dosiahol. Obmedzený pohyb nahore ukázal aj Litecoin/Bitcoin, ale k otvoreniu nákupného obchodu nedošlo z už avizovaných dôvodov.

What is electronic money and why is it important to use cryptocurrencies?

Digital currency.. Also called electronic money, electronic currency, digital money, or e-money. It is spoken about electronic money or digital currencies a lot. Because there is a lot of kinds of them, not every digital money is as other digital money.

In this article we look at what electronic money is, what digital currencies we know, why it is important to use cryptocurrencies, and which of the cryptocurrencies most closely approximate cash.

What does electronic money mean?

Electronic money is money that is exchanged exclusively electronically. Examples include credit and debit cards, various currencies used in computer games, or the exchange of goods and services over the Internet, such as cryptocurrencies.

There are many global payment systems supporting online activities that are used by millions of people. For example, WebMoney Transfer, Skrill, Transferwise, or the most famous Paypal. Similarly, for example, the Payza online payment system allows you to convert a digital currency between accounts that are identified by e-mail addresses. Payments through these systems are accepted by thousands of online retailers and service providers around the world.

The largest and best-known decentralized digital currency is Bitcoin. In addition to this cryptocurrency, there are several hundreds to thousands of others, mostly focused on a particular purpose. In addition to a variety of digital currencies and payment systems, there are also digital currency exchanges where users exchange different currencies for others.

What digital currencies exist out there

Digital currencies can be divided into several kinds depending on what we want to explore. One of the criteria is how digital money originates and works. Most of today’s well-known e-money and payment systems are based on state currencies, which are so-called legal tender and have a monopoly position in the country of use.

The value of state currencies was once linked to commodities such as gold or silver. But this is long gone, and at present such “bad” money is covered only by the promise of the state. It can be seen also on the example of the euro, that such a currency is only a toy in the hands of the central bank and politicians.

And of those who are most interested in maintaining inflation, which devalues the value of state currencies. The average duration of existence of any state currency in history is about 100 years. Current state currencies are already digital rather than physical. Just go to a bank with a demand to withdrasw a cash of higher value …

Continuous cutting off of financial freedom and increasing capital controls is linked to the sharp rise of alternative digital currencies. One of the first was e-gold. An account denominated in grams of gold allowed an immediate transfer of value to another e-gold account. In 2009, this electronic money was used by about five million people. The US government subsequently forced the operator to stop the transfers and the whole business. Because tt threatened the monopoly of the US dollar as the only state currency.

Just by coincidence (or maybe not) Bitcoin was born at this time. The first decentralized P2P digital money. Attribute of decentralization is often mentioned and for a good reason. All previous currencies had been centralized until Bitcoin’s rise. That means a specific institution, company, organization, or other entity guaranteed, and was responsible for their value. They were centralized in the hands of a few decision-makers who would always betrayed users after all.

Bitcoin is alive just because of its decentralization feature. It can not be canceled by one signature of some official or by a law. No institution, company, nor person emits Bitcoin. It is a network of interconnected computers of users. It’s the internet money.

More and more governments has been talking about digital money. For example, Sweden, China, India, Russia and others. This is also related to the effort to eliminate cash in the economy. National digital currencies already exist today actually. A substantial portion of payments, including credits, loans, mortgages is executed via bank cards and online transfers.

Of course, digitization of money suits governments and banks that want to control the lives of people and thus keep an excellent track of their activities, interests, preferences. It is not needed here to expand on the fact that such information can and will be abused widely.

Why it is important to use cryptocurrencies

As already mentioned above, cryptocurrencies based on the so called “blockchain” technology, also emerged as a response to the outdated and corrupted banking system of fiat money. The state and central banks want to keep even forcibly their monopoly on money and unlimited power.

That also involves the fight against cash. They say tt is because of terrorists, drug dealers and tax evasion. But it is only a smokescreen and the usual justification of politicians in any circumcision of human freedom. Stopping cash payments and making a full transition to a cashless economy will mean more spying, collecting personal data, misusing them, and people losing virtually any control over money.

The bank may send payment or not at her own discretion or based on rules enforced by the state. Yes, paying with bank card is convenient. But the list of pros is thus fulfilled.

Your money in the bank is not really yours. You only lend them to the bank. And you run the risk that suddenly one day your account balance will be reduced by half because of the “X” or “Y” measure. No, it will not be called confiscation officially. In fact you will pay interest to the bank for a “kind opportunity” to “save” the euro, dollars, pounds at their accounts. The period of of negative interest rates is coming, as the higher rates and price of money would put the system very quickly into a sef-destruction movement. That’s why their fighting against cash. Cash can not be controlled by the state.

How to get off the treadmill? It’s simple. Using cash as often as it gets. If cash payments are completely displaced from the economy, which is not an easy task at all, there are free, decentralized digital currencies representing digital cash. They can also be forbidden, but such a ban will not work. Their popularity will grow even more.

Only you decide about your money when using free digital money. It is only your choice what you want to spend it for, who you send it or in what amount. You do nothing wrong and it is none of anyone’s business. It is almost tragicomic that in the 21st century, someone snoops on you over your shoulder and can see what you are doing with your money and “serves” as a payment intermediary without whom the transfer would not take place. Not to say that for this very limited “service” (if it can be called that at all), the bank often asks for an inadequate fee.

With cryptocurrencies you are your own master. Under all circumstances. In addition, it is faster, cheaper, safer and substantially more private. It only takes time and practice to learn how to handle them.

Which cryptocurrencies are like cash

The most widely distributed and currently also the most valuable decentralized cryptocurrency is Bitcoin. It is like gold among precious metals. It has been in operation since 2009, and all previous attempts by envious and ill-wishing people to get rid of this value storage have ended in failure. Bitcoin infrastructure represents the most advanced and developed infrastructure of all cryptocurrencies – exchanges, btc atms, wallets, plenty of stores accepting main cryptocurrency.

It is possible to mark Litecoin – another cryptocurrency, as the younger brother of Bitcoin. Sometimes it is called bitcoin testnet because of a very similar principles on which the oldest cryptocurrency is based on. Bitcoin developers can first try out here how the cryptocurrency would behave. Similarly to other altcoins, Litecoin’s dollar value has increased significantly over the past few months.

There is a growing demand for Litecoin as Bitcoin substitution for a payment tool thanks to the smooth running, speed and cost of transaction. Some cryptocurrency ATMs already support Litecoin payment (Cryptodiggers in Bratislava) and can be used in several stores such as Subway in Brno and Bratislava (Nivy) and Prague’s Parelni Polis.

Bitcoin and Litecoin represent so called “pseudonymous” digital currencies. These cryptos retain a certain degree of privacy while transfered. There is a permanent recording on the blockchain network where exact date, amount, and addresses of a transaction can be found. These addresses, however, can be used to link some of used addresses and historical payments already executed to trace virtually all of the transaction history. Then it is simple to link the cryptocurrency address with a specific name in the exchanger, or the bank. Bitcoin and Litecoin are therefore not anonymous cryptocurrencies, which in every case respect your privacy.

However there are other cryptocurrencies which can termed as anonymous digital money, such as Monero, Zcash and other smaller or emerging alternative digital currencies. Considering technical aspect these work on completely different principles than Bitcoin. Therefore, they are still used for specific purposes so far, and their acceptability at conventional crypto-supporters or in practical applications is very limited.