OK, I must admit it. Bitcoin keeps surprising me as a trader. The last time I wrote here about having a pause in BTC/USD trading (as would have traded it for years, yeah? 🙂 ) and expecting some weeks or months of low volatility practically disabling profitable trading. It looks like I was wrong. Yes, the volatility has decreased comparing to the crazy weeks before, but it is still possible to book some good pips in.

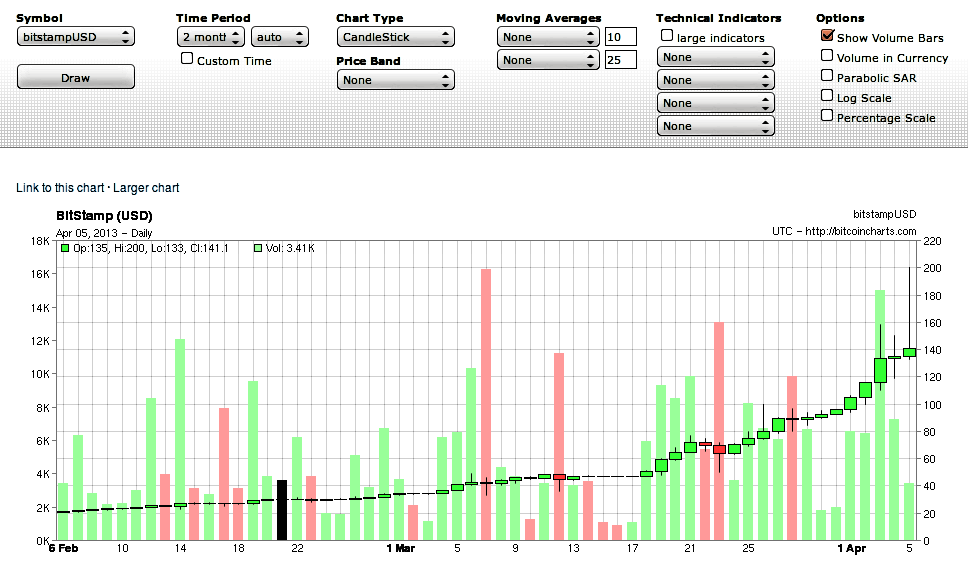

So what’s the current story? Looking at the Bitstamp USD chart the price has recently broken an important turning point at $120 and heading to another at $150. So this can be the target in the next days maybe weeks depending on the upmove strength. As this climb isn’t very much persuasive for me it is necessary to look carefully downstairs also. And there is strong trendline support now around $100. But for the market to attack this level I don’t know what kind of serious event would have to occur for it to come down there. Especially when you consider the recent Dwolla/Mt.Gox problem, that was quite a huge negative story and the price is up. That is telling me something. And maybe BTC just doesn’t give a fuck of this (or any) “news”.

OK, when you haven’t bought in the recent hours then do it as soon as possible. As said above my buy target (PT2) is $150, but first it should cut through $140 (PT1). The stop-loss set up at $127.50. And that is also the sell-point with the stop-loss at $130.50. If triggered my first profit target is $124 and the second at $123 (let’s be careful here, the trend is up). Good luck!