Just a quick recapitulation of the last week trading result:

3,7% when you exited according to the plan

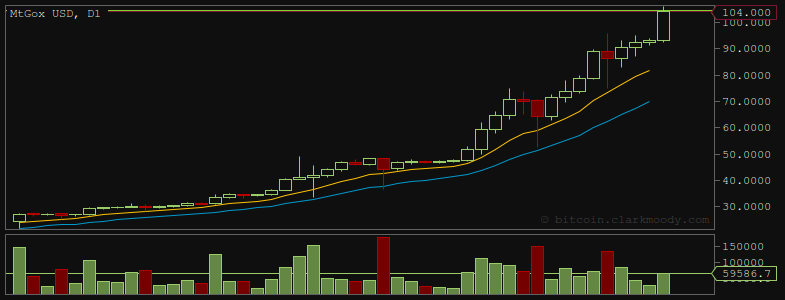

38% return when you exited at week’s high (the highest possible return)

The target was too much conservative and I can adjust it in the next plans because a daily returns are increasing so our weekly target also will. But remember, these trades are a short-term ones and our goal is to be profitable and generate some cash-flow in a long-term, whether the market is trending up, down or consolidating. That’s why I choose such a “conservative” targets. Of course the final cut is always on your decision.

Also, look at the profit difference of maximum potential (38%) and our target (3,7%). That’s why I keep saying you profit most in this market when sitting tight with your long-term buy position from the start of this rally. Be it 0,1$, 1$ or 10$. Well if you weren’t so lucky (smart) and have bought just recently the same applies. Because this market is heading higher, much higher. That doesn’t mean it can’t drop below 100 or 80$. But when you play a long-term game that potential sell off wouldn’t be much to bother with. Because from here it can go to 70$ and technically still perfectly stay in the bull market.

Now to the current outlook and trades.

It looks like our trading week should start on Sundays. Bitcoin is live 24/7 and doesn’t know weekends and sometimes even a banking holidays.

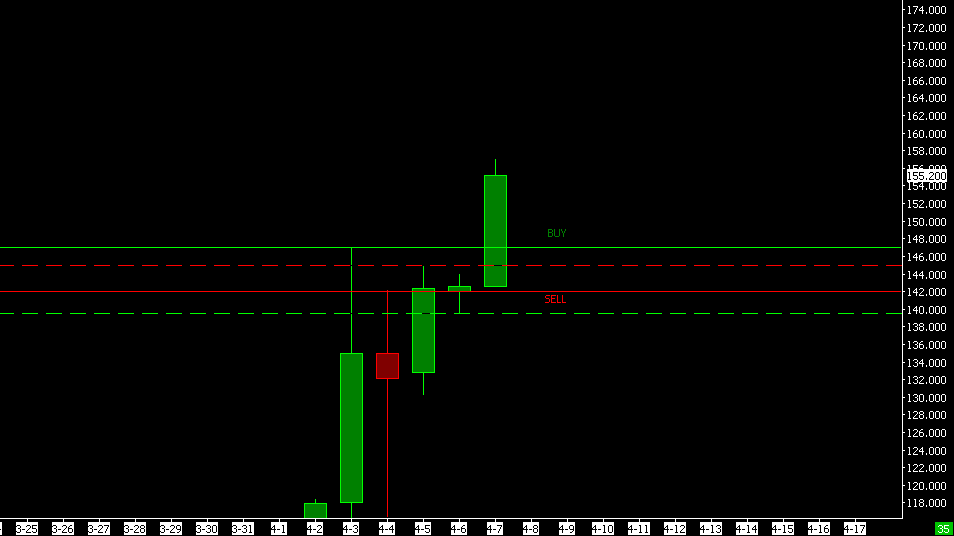

The USD/BTC price on Mt.Gox broke through 147.05 today, that is going to be our buying point for the next week. You can place a stop-loss order just below 139.50. If the market wants to head higher, this level should have been safe. I was too much conservative last week as regards the profit target. So now let’s set the first one at 179.00, the 2nd at 199. In case of this buying frenzy will continue the same pace as in the previous days, we can easily see Max Keiser’s short-term target of 250 USD been hit.

What about a sell point? What? Do you really want to short this market? OK, then try to enter at 142.05 with the stop-loss at 145. First PT at 140.00, 2nd 135.20.

Hmm, now let’s hope the price is going to correct to the buy point or 150 at least.