The recent Bitcoin price swings has been only about China. Most of the bitcoin trading volume is executed in Chinese yuan, a currency facing prospects of fast and furious devaluation. The BTC/USD pair has been stucked in low price change range over the past weeks and this non-volatility has been driving a lots of traders crazy. What’s next in store?

Arthur Hayes, the CEO of bitcoin futures exchange Bitmex, predicts “the PBOC will schlong the CNY by devaluing it 5%-10%.” He believes it’s going to happen during the coming Chinese New Year holiday when there’s no immediate capital outflow risk.

“Looking through monetary history, central banks and governments like to unveil massive monetary policy changes during the weekend or bank holidays. The PBOC is quite lucky; the Chinese New Year holiday presents an excellent opportunity to massively devalue the Yuan and cut interest rates without the threat of capital flight. The Chinese banking system and capital markets will be closed from February 7-13. During Chinese new year, all things financial come to a halt. The PBOC has free reign to duck hunt dormant capital with impunity.”

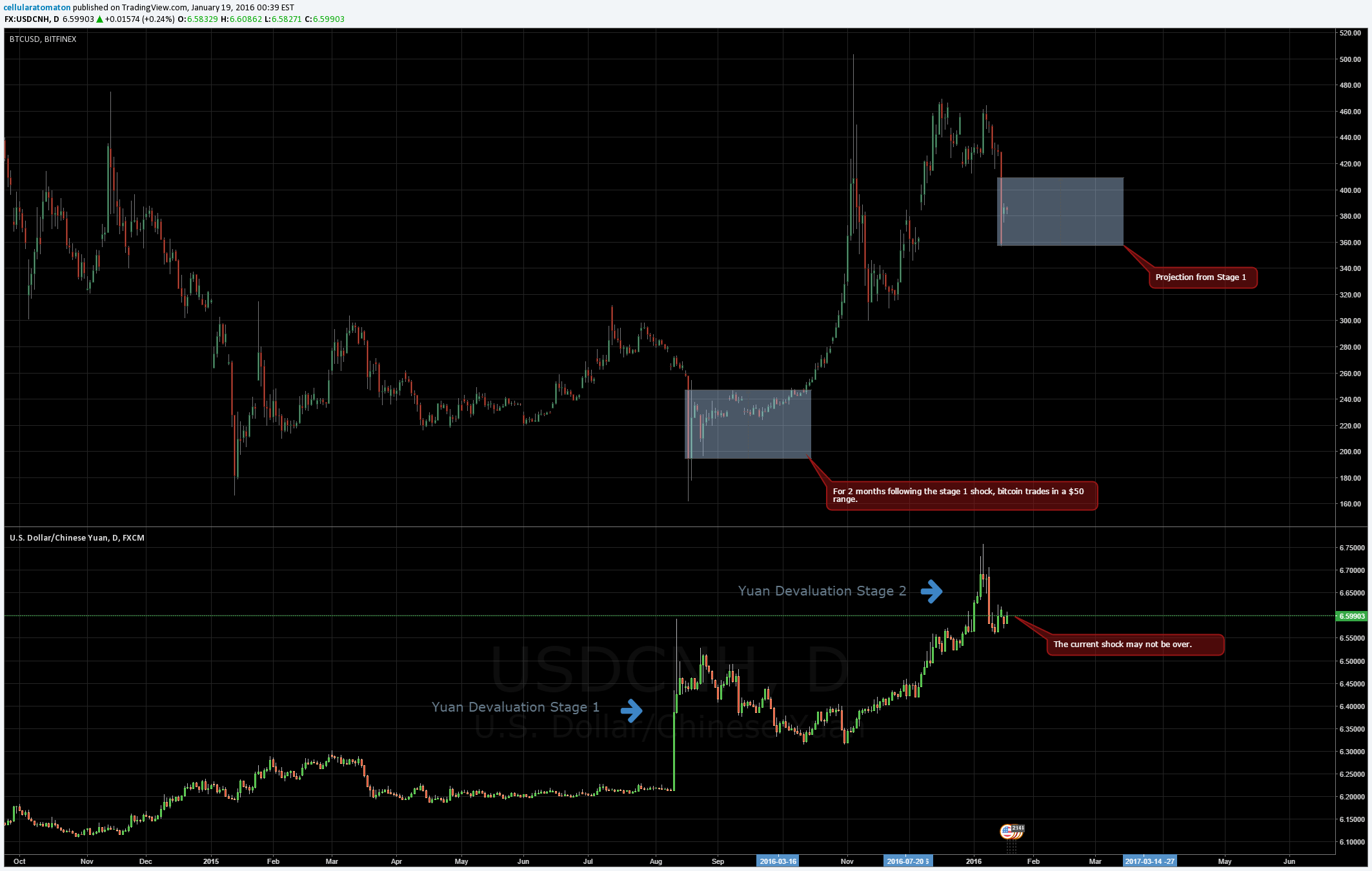

So what does this all mean for the BTC/USD speculators? Have a look at the chart (not my production) below and figure it out. Ok, I can help you if it wouldn’t be obvious. The first yuan devaluation stage were accompanied with the sudden BTC/USD price decline followed with longer-term (2 months) price consolidation in $50 range. Then the monster Bitcoin buying rally came.

The second stage has already started though not on any massive scale. If Hayes is right the largest damage in this phase should come during the 2nd week of February. That could push BTC/USD down to the $330-350 level or even lower with a brief spike. Then a consolidation period and then…you know it already. To the moon! (Or not)