A four consecutive red days + yesterday’s close below 100$ all indicate that a possible bounce of the low doesn’t have to be so persuasive as it looks according to the Friday’s daily candle. If you’d look carefully at the chart you can’t find more than two consecutive red days from the start of this rally in December/January. Also the 60% retracement level from the top has been breached, that most traders consider to be a last barrier for corrections in trending markets.

Now the real trading can start. It is not hard to book some good profits, when the market is increasing by dozens of percent day by day. Every monkey trained in pushing a right buy and sell button can be profitable in those conditions.

So what to expect in the following days? I’m still a long-term bull, not so much in the short-term outlook. No market however strong fundamentally can grow exponentially forever. A steep up move is followed by a periods of consolidation or a sudden and big falls. BTC/USD has experienced strong increases since January that resulted into the sudden fall last week. Now it could have to be a time for some rest.

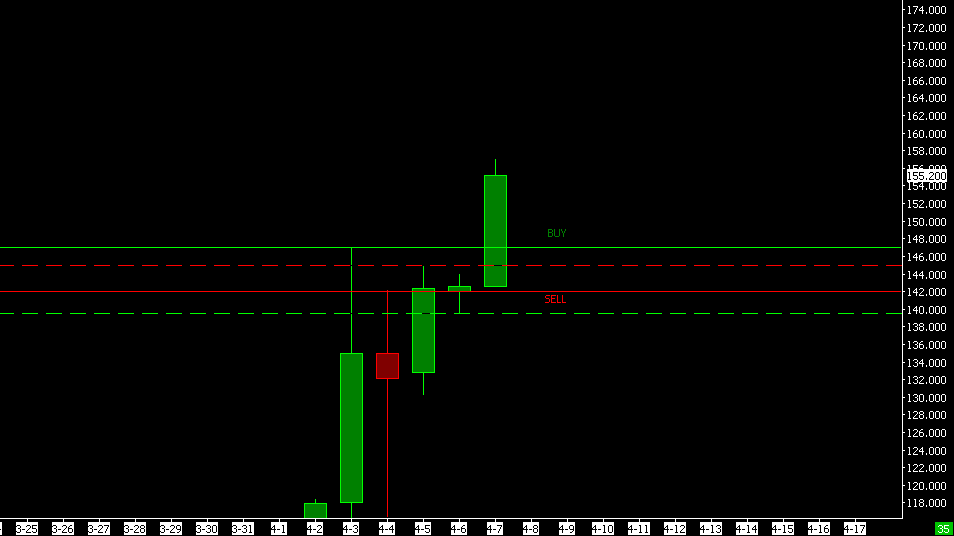

A brief review of the last week trades:

Buy TP1= 22%

Buy TP2= 35%

Buy TP3= 70%

If you’d taken the sell trades, they would be profitable also:

Sell TP1= 1,5%

Sell TP2= 5%

Here are the trading points for the coming week (based on the Bitstamp data):

Buy: 100.20 SL: 94.80 TP1:111.70 TP2:118.70 TP3: 133.20

Sell: 89.80 SL: 95.00 TP1:85.20 TP2: 70.00 TP3: 51.00

My personal bias is down, but let the market decide the direction. Do not forget, trading is not about foreseeing the future price, but to be prepared and react on what the market is offering to you. Respect it.