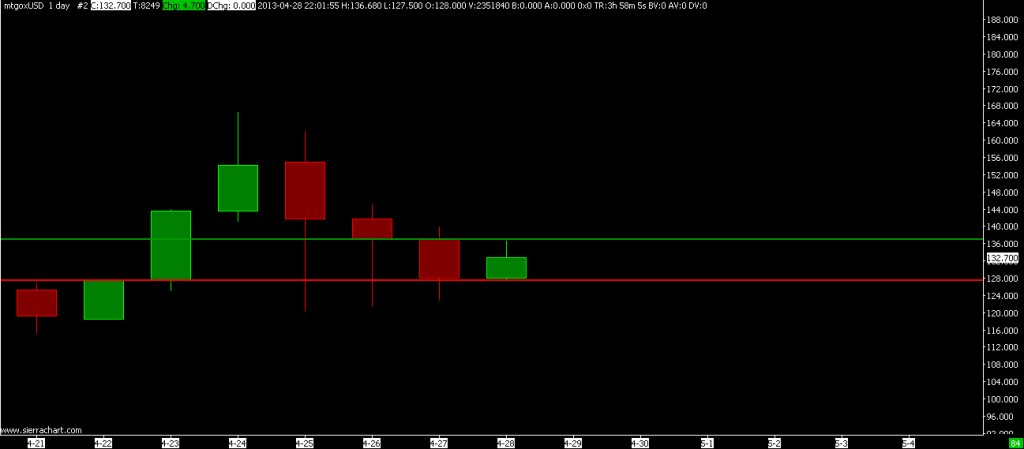

After a calm comes a storm and vice-versa. The price of BTC/USD pair oscillated around the $100 zone for three weeks and it was quite hard to book some decent profit with this weekly strategy.

As with all other tradable instruments, at these times the most important is to preserve your capital, do not lose much and wait for a next big move. And the one came last week.

Is that down move finished now? I don’t know. But I doubt it. The speed and volume of the sell-off would suggest even lower levels are on the way soon. The current down leg should attack $50 zone first before any possible bounce off or continuing sell-off.

Bitcoin Trading Plan

With that said let’s lay out this week’s trading plan (Bitstamp chart):

Sell point: 63.00 SL: 70.00 Profit target: 53.00

Buy point: 73.00 SL: 68.00 Profit targets: 79.00, 82.00

My bias is still down, so I don’t want to open a long position before the market attacks $50 zone first.