You know those moments you have opened short position because there is no other way market can go and after several weeks of stand-off you are nerved out and tired of choppy market so you finally close it at break-even just to see the price crash down another day with your planned profit hit in a few minutes after the break?

Well, that happens sometimes. And also closing the trade with huge loss (if not the margin call) happens in these cases when the trend reverses. That’s why it’s good to use stop-losses (physical or mental).

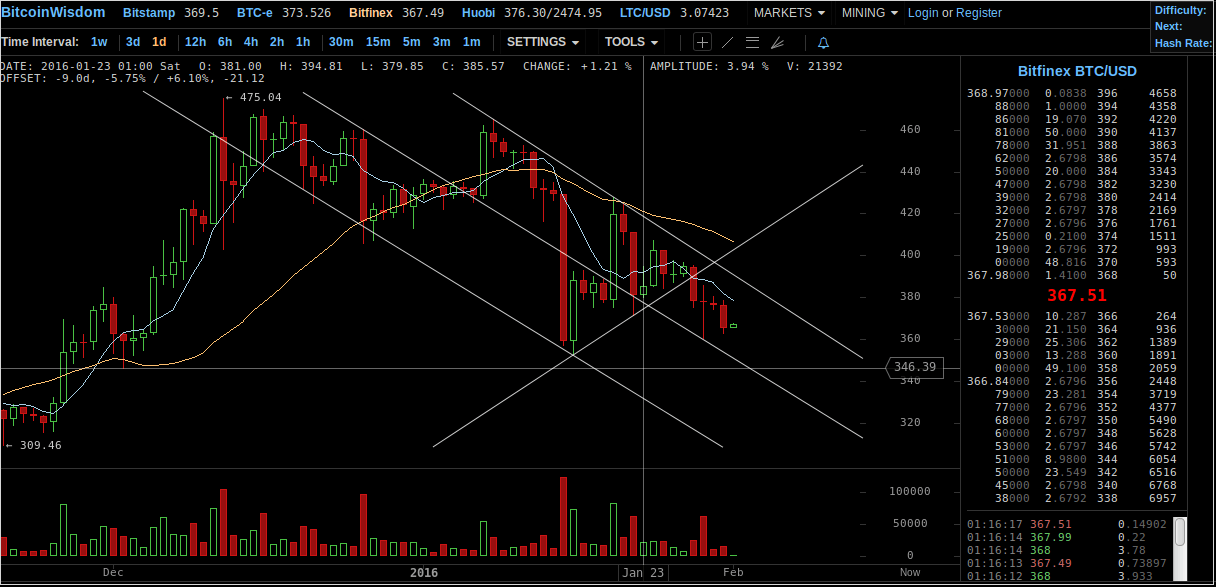

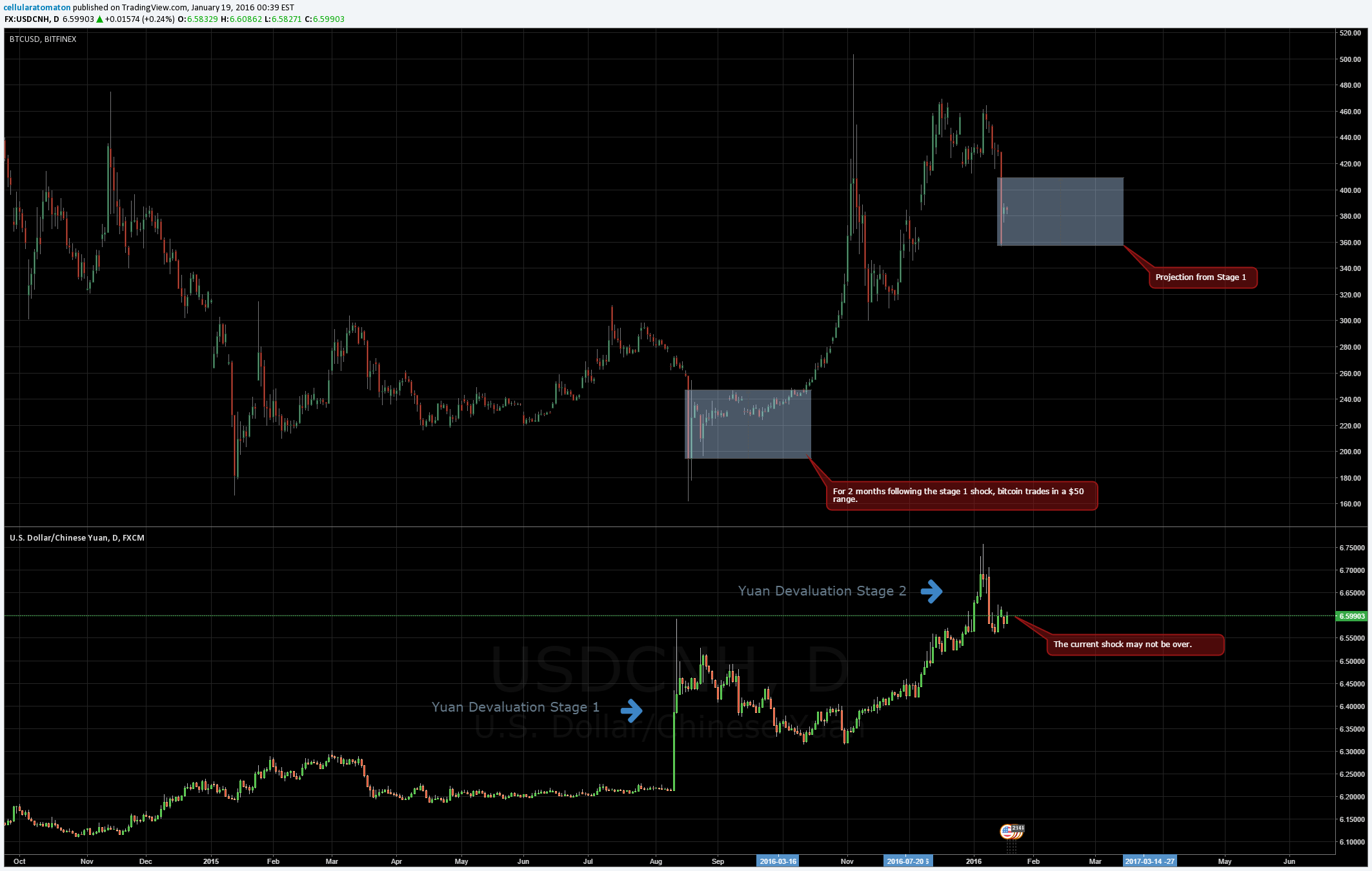

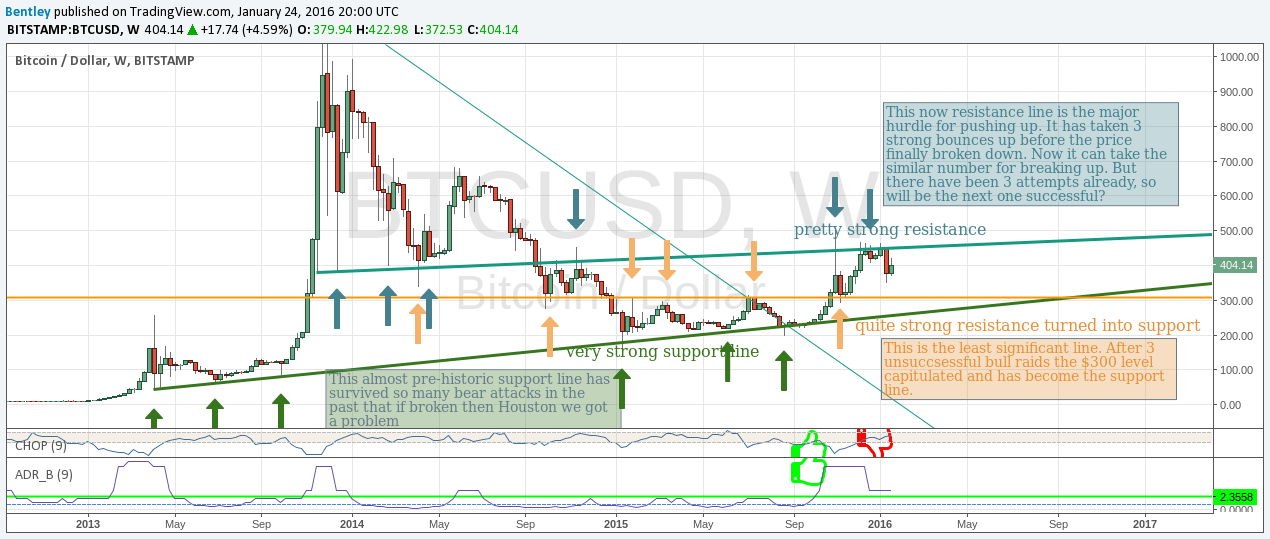

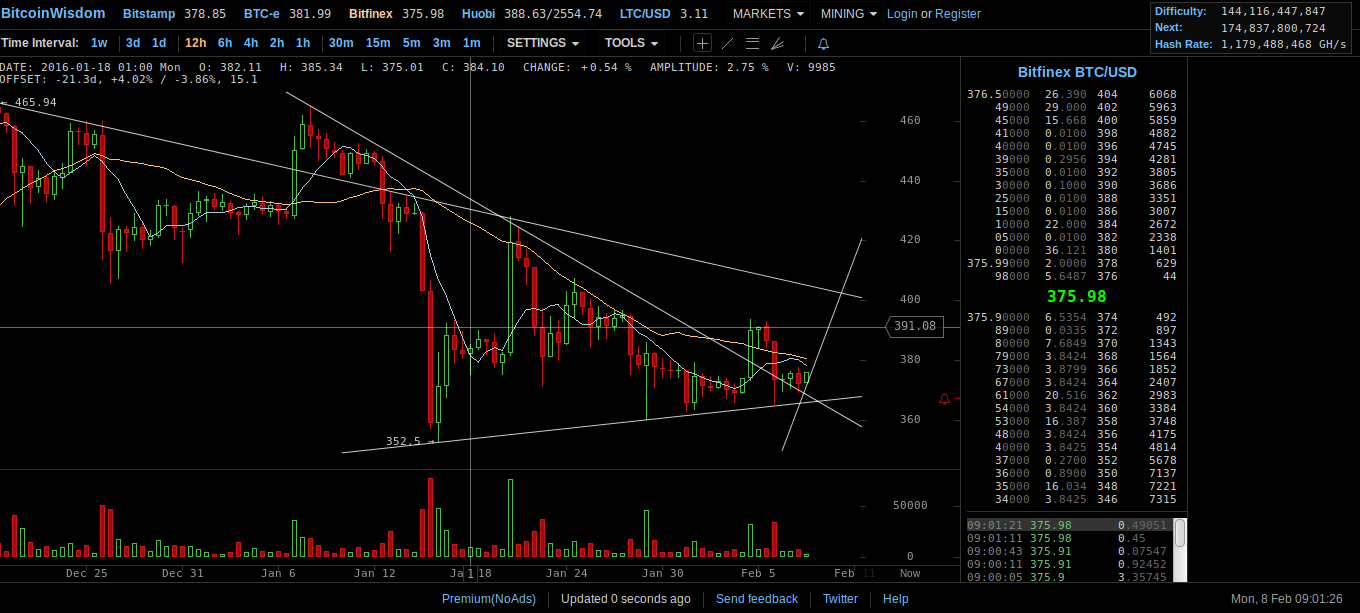

China New Year’s holiday is here and many traders expect fervently whether the PBOC will make its devaluation move during these days. Either way the price action looks bearish and I can’t see any reason for opening any substantial longs. However I wouldn’t be surprised first to see some buying shots during the week and Friday/Saturday/Sunday some massive sell-out

as has often been the case.

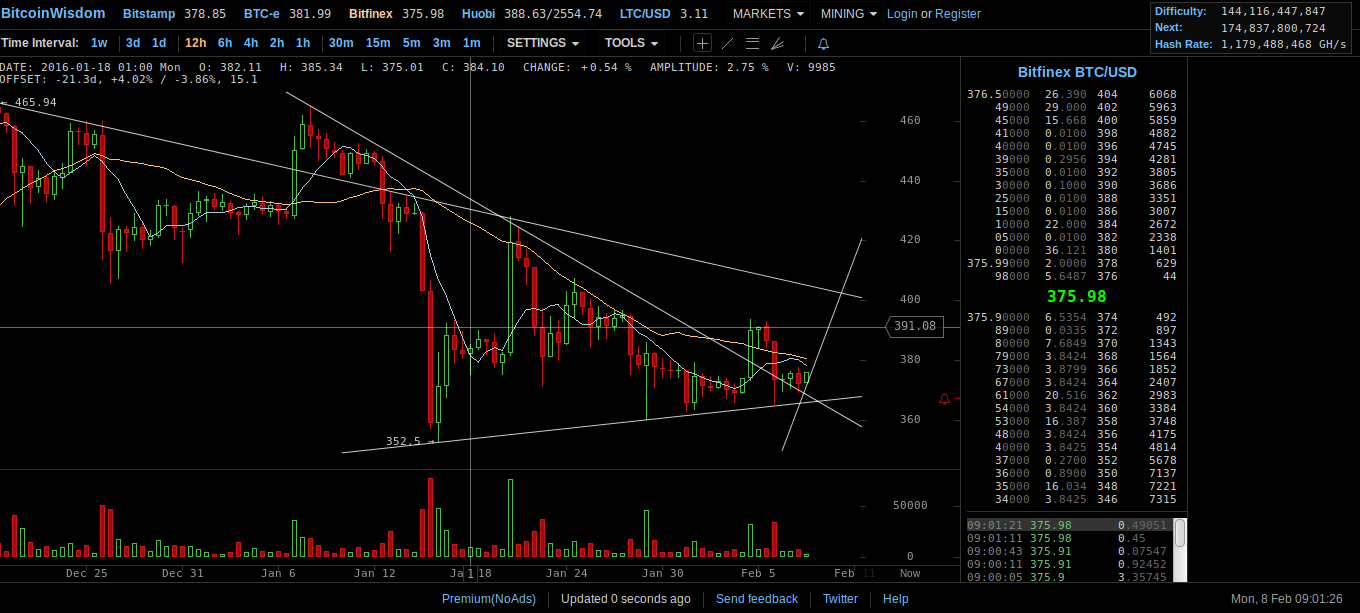

Buy: 378 Stop-loss: 373 Take Profit: 388; 392; 398

Sell: 369 SL: 374 TP: 359; 349; 335

Trading forex scamcoins?

Strong: really hard to pick even mildly strong:) Maybe Jpy, Gbp

Weak: Aud, Cad

Indices:

DAX: still in the choppy zone, looks more bearish now and about to see 9000.

DJ: choppy, the least bearish of all 3 indexes followed here.

Nikkei: bearish below magic number 16666, bullish above.